Our friends at TwenytCi have released their latest news on the housing market and try to explain the unusual activity taking place and why house prices are still rising.

TwentyCi is an information and marketing services company that provide UK residential property data, analytics & insight.

Their top headlines this month are:

- In 2022 to date, housing supply is down 5% on the prior year and demand is down 16%.

- If demand is down more than supply, then why are prices are still rising?

- With lower-priced property, there is no slack of stock and 100% of what is coming to the market is being sold.

- Aspirational demand is still very strong, but demand is falling because there is not enough supply.

- Prices, therefore, whilst already high against some historic norms, seem likely to continue to rise.

Looking forward the UK economy is more than uncertain, food, fuel and energy prices continually rising and inflation reaches a 30 year high. With this happening we would expect the housing market to suffer too.

They reference 3 key areas

- Supply

- Demand

- Prices

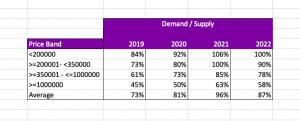

Their stats show that in pre-Covid times approx. 70%of properties that were instructed for sale went on to achieve a sale agreed on them. In 2021 this changed to 96%. Highly unusual. This is to date now running at 87%.

Put that against supply being down by 5% in 2021 and demand in 2022 down by 16% in 2021 you would assume that prices would fall. However this is not what is happening.

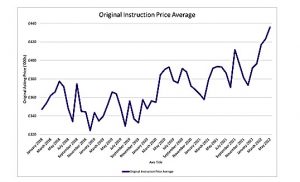

As we know in May 2022 the average asking price still continued to rise by 3% in the month since April 2022.

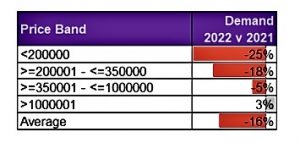

This table shows the variance in demand during the first five months of 2022 compared like for like with 2021, but this time cut by price band.

The following table shows the variance in demand during the first five months of 2022 compared like for like with 2021, but this time cut by price band:

To understand this, they went back and had a look at the relationship between demand and supply by price band and year: Going back to the “normal” year of 2019, of all the sub £200k properties listed, 84% of them sold. Last year, the figure was 106% – in other words, the country selling more than what is available so stock runs dry.

In the first part of 2022, demand for sub £200k properties match supply – so everything is selling.  So where the supply slack that existed has been used up and everything that comes onto the market at lower prices is selling.

So where the supply slack that existed has been used up and everything that comes onto the market at lower prices is selling.

As such, even though the volume of sales agreed is falling, there is no issue with demand at all – TwentyCi presumes it may well probably remain stronger than ever. In fact, the important measure is not how much demand is falling but how much of the supply is being sold – and that’s 100% right now!

Their view is then the major issue, therefore, is with supply because you can’t buy what’s not on the shelves. And prices will undoubtedly continue to rise even though the economy may well be heading for a recession.